Oct 3, 2020

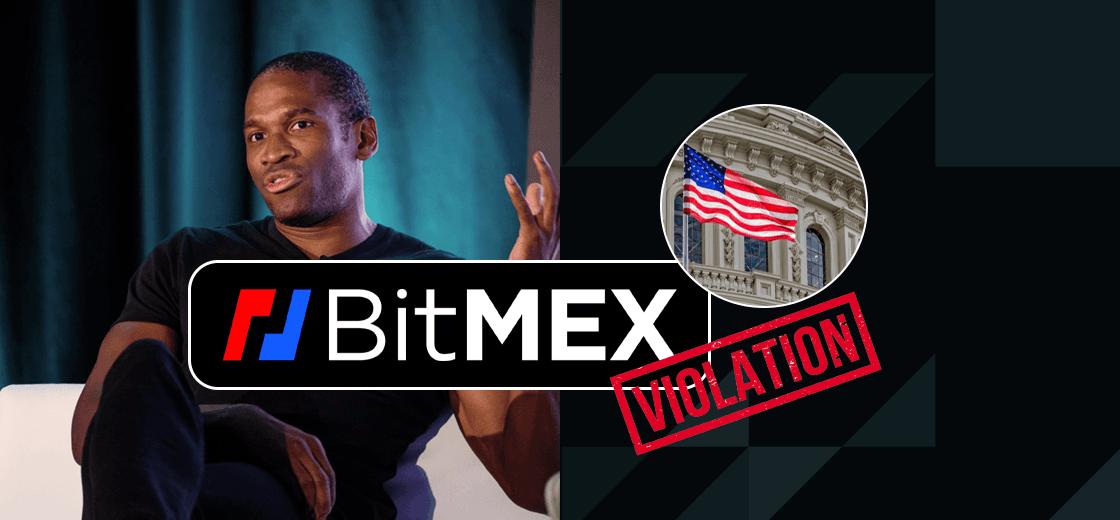

BitMEX Co-founders Charged For Violating the U.S. Bank Secrecy Act

Varinder is a Technical Writer and Editor, Technology Enthusiast, and Analytical Thinker. He also holds a Master's degree in Technology. Fascinated by Disruptive Technologies, he has shared his knowledge about Blockchain, Cryptocurrencies, Artificial Intelligence, and the Internet of Things. He has been associated with the blockchain and cryptocurrency industry for a substantial period and is currently covering all the latest updates and developments in the crypto industry.