Feb 19, 2021

by Sahaj Sharma

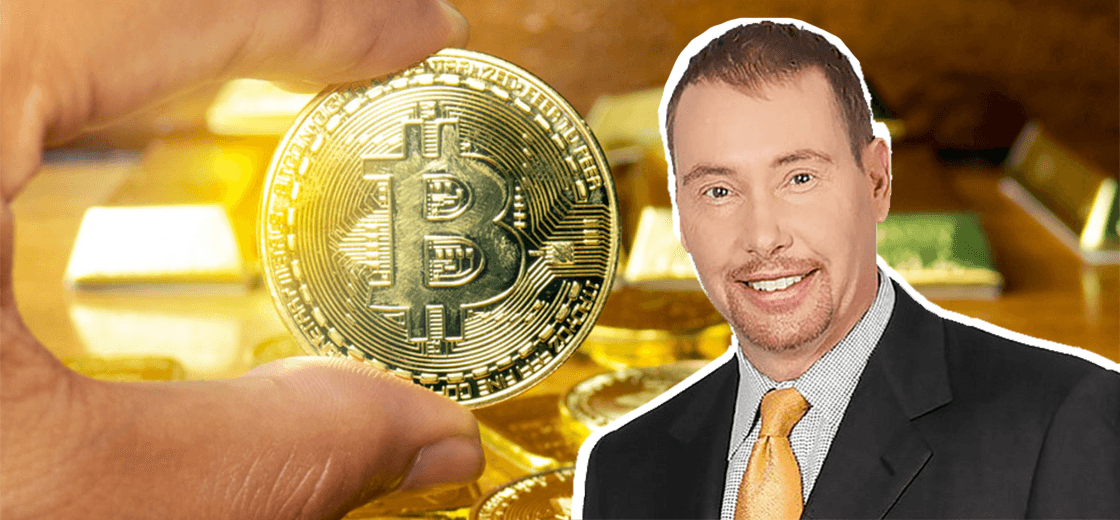

Jeffrey Gundlach Suggests Better Bet on Bitcoin Over Gold

Sahaj is an aspiring journalist with a keen interest in cryptocurrency and the whole concept of Blockchain technology. He is positive about the future potential of Cryptocurrency and Blockchain in shaping the world of finance for good. At present, he is covering the latest developments in the field of the cryptosphere.