Feb 10, 2021

by Godfrey

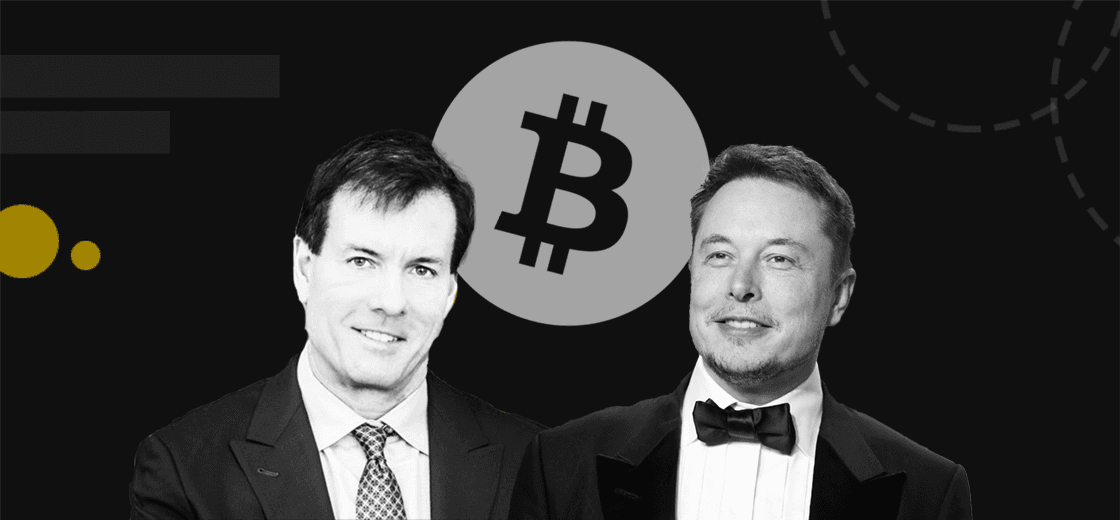

Are the Bitcoin Bulls Bullying Corporate Investors to Adopt Bitcoin?

Godfrey is passionate about Blockchain technology and is both an active researcher and writer in the space. He has written for several Blockchain and crypto news site and relishes educating the public about the emerging tech.

Besides being a diligent daily News writer, Godfrey has expertise in and covers contents related to technical analysis, Central Bank Digital Currencies (CBDCs), DeFi and opinion pieces.

He believes that with constant awareness, everyone will be exposed to the potentials inherent in Blockchain and it's associated innovations.