Sep 30, 2021

by Kavya Barua

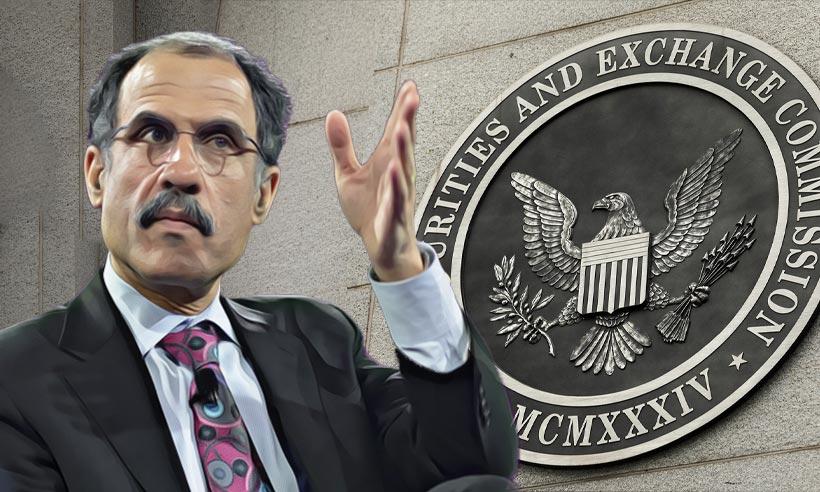

Dan Berkovitz Begins His New Position as General Counsel of the SEC

.

Disclaimer: The views and opinions expressed in this article are for informational purposes only and do not constitute financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Kavya Barua is a voracious learner who is fascinated by crypto and Fintech advancements. Graduated from Janki Devi Memorial College's B.A (Hons) English program at the University of Delhi. She aspires to be a successful professional, having a keen interest in learning and achieving results.